Compound Interest Computer

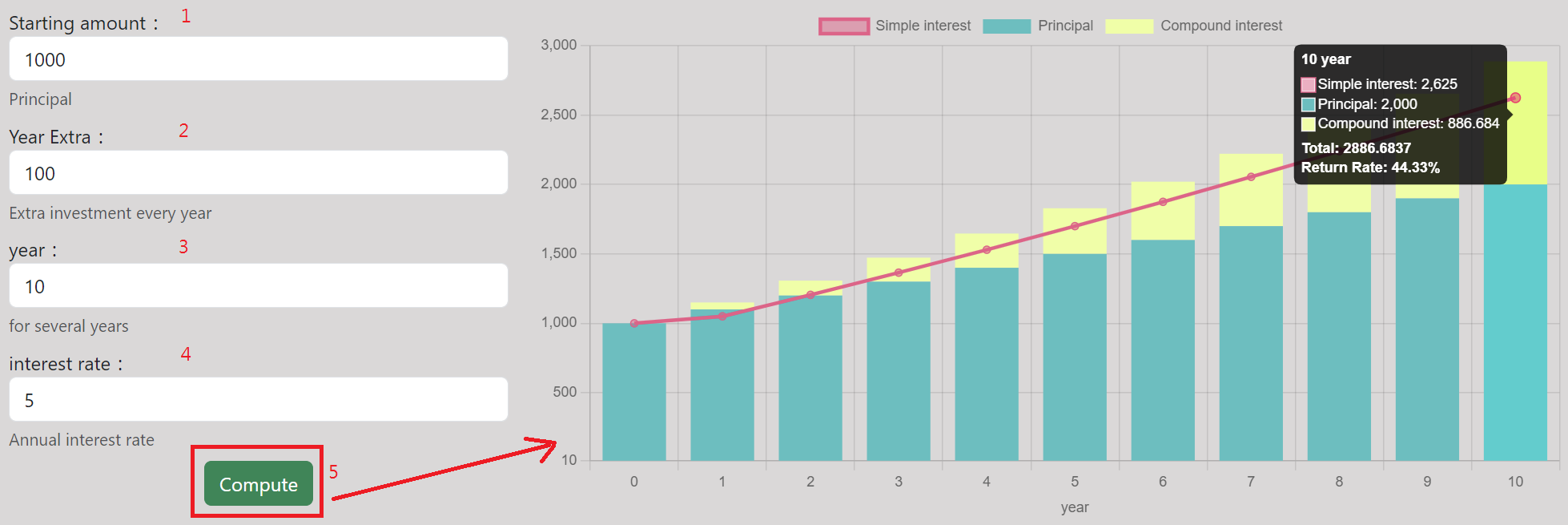

- This compound interest calculator shows how your investment grows over time.

- With our compound interest calculator, you can visualize the powerful effect of compound interest and see how your investments and savings grow steadily over time.

Use example

What is compound interest?

"Compound interest" is a financial calculation method. It not only calculates the interest generated by your principal, but also adds these interests to the principal to calculate new interest together, forming a compound interest effect.

Analysis of compound interest formula

FV = PV(1 + i)n

FV (Future Value): Future value, that is, the expected value of your investment at a certain point in the future.

PV (Present Value): Present value, that is, your current investment amount or principal.

i: annual interest rate or expected annual return.

n: The number of investment periods, usually in years.

The powerful effect of compound interest

For example: principal 100, annual interest rate 20%.

| First year | Second year | Third year | |

|---|---|---|---|

| Compound interest | 100 * (1+20%) = 120 | 120 * (1+20%) = 144 | 144 * (1+20%) = 173 |

| Simple interest | 100 + (100*20%) = 120 | 120 + (100*20%) = 140 | 140 + (100*20%) = 160 |

From this example, we can see that the effect of compound interest increases over time. The investment return in the second year is 4 more than the first year, and the third year is 4 more than the second year That’s 13 more. That’s the power of compound interest, your investment returns get better and better over time.